When "living healthy" was a new idea, a famous spa, Canyon Ranch, asked me to speak to people who aspired to a healthy simple lifestyle. I spoke to them about their risk of living beyond age 100.

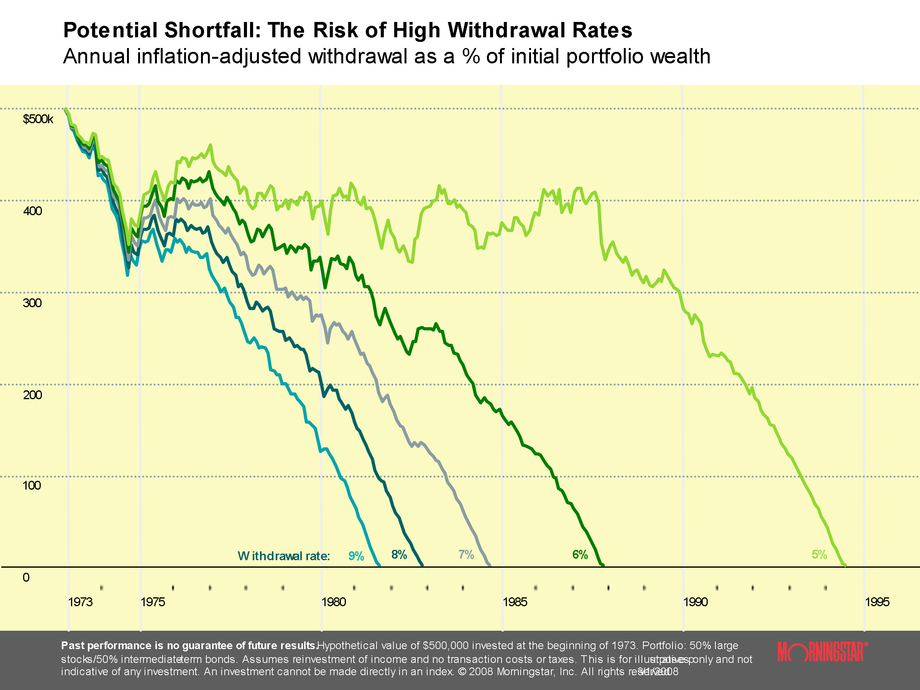

The Social Security Administration did some research they released recently that suggests that Conservative Investors make a mistake when they take their benefits before age 70. They presume they will not live long enough to cover the difference of the higher amount, but later. Consider your risk if you make a mistake by one percent of return on investment, or one extra year of life. Old style pension, still available to some, uses the "G word", guaranteed, concerning Guaranteed lifetime income. Lifetime. With 401k plans now commonly used instead of pension, that offer no guarantee of outcome, it has been predicted for years by professionals that many folks will simply run out of money.

You may have been told the same things I heard years ago about long-term investing. Does it seem to change much? Put some here, some there, lose here, gain there. I was told to tell my clients to count on double-digit annual returns, and a big percentage each year as income. With Reaganomics, you could get 14% on an IRA for five years from a bank, that is, before interest rates changed, perhaps forever. Your jumbo mortgage was 12% however. If you check the years in the graph, in those years the market went up and up and up..except for one big shock. We have had two or three such shocks in the current generation of workers.

Volatility is a whole separate topic and it is the current trend in management by the very best, in my view. Managing for volatility avoids striking out while trying for a home run and instead encourages base hits, to adapt a famous baseball reference.

The other details? And...in my view, the Industry forgot a few details. Exactly how long will I live, and my spouse, and what will our health be like, and how much will my living expense be, and my family, will they help or need my help.. And another very huge topic..., how much will a Retirement Dollar be worth in an ever changing International Economy.